pa auto sales tax

Payment can be made online when completing a PA-1 Use Tax Return. The purchase of a vehicle by the person who will transfer it to the winner is subject to tax.

Nj Car Sales Tax Everything You Need To Know

If you trade in a vehicle only the difference between the value of the trade-in vehicle and the purchase price of the new vehicle is taxed.

. The VRT is separate from and in addition to any applicable state or local Sales Tax or the 2 daily PTA fee. 8 sales tax in Philadelphia County. 1 percent for Allegheny County 2 percent for Philadelphia.

Pennsylvania sales tax is 6 of the purchase price or current market value of the vehicle 7 for Allegheny County and 8 for the City of Philadelphia. With local taxes the total sales tax rate is between 6000 and 8000. Sales Tax Exemptions in Pennsylvania.

PA has a 6 sales tax rate for motor vehicles. How Much Is the Car Sales Tax in Pennsylvania. The Pennsylvania state sales tax rate is 6 and the average PA sales tax after local surtaxes is 634.

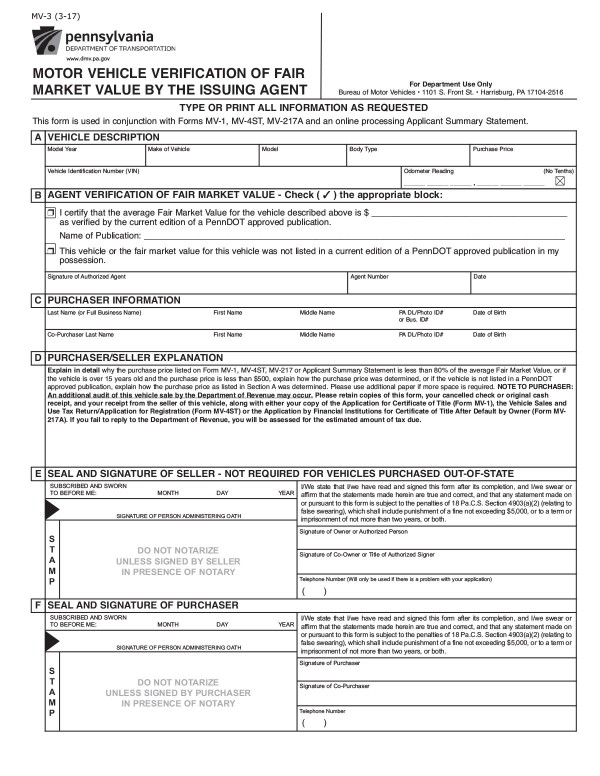

The state sales tax rate in Pennsylvania is 6000. 2022 Pennsylvania state sales tax. Many taxpayers are unaware that sales tax due to the Department of Revenue is a percentage of the fair market value of a vehicle rather than a.

These taxes must be paid on the vehicle before registration is completed. 260 per pack of 20 cigaretteslittle cigars 013 per stick Malt Beverage Tax. 6 percent state tax plus an additional 1 percent local tax for items purchased in delivered to or used in Allegheny County and 2 percent local tax for Philadelphia.

The following is what you will need to use TeleFile for salesuse tax. Maximum Local Sales Tax. For instance if your new car costs you 25000 you can expect to pay an additional 1500 in state sales tax alone.

This page discusses various sales tax exemptions in Pennsylvania. 2 to 3 hours. Its a matter of fairness.

2022 List of Pennsylvania Local Sales Tax Rates. 1 per tire fee is imposed on the sale of new tires for highway use in Pennsylvania. Select the Pennsylvania city from the list of popular cities below to see its current sales tax rate.

Motor Vehicle Lease Tax. In Pennsylvania certain items may be exempt from the sales tax to all consumers not just tax-exempt purchasers. State Tax Rates.

Typically when you buy a car in a different state than your home state the car dealer collects your sales tax at the time of purchase and sends it to your home states relevant agency. According to the Pennsylvania Department of Revenue the state sales tax rate for motor vehicles is 6 percent which is the same rate for other items that are subject to. Less than 2 hours.

PA DEPARTMENT OF REVENUE. Harrisburg PA 17106-8597 unless the seller is planning to transfer the plate to another vehicle. Some examples of items which.

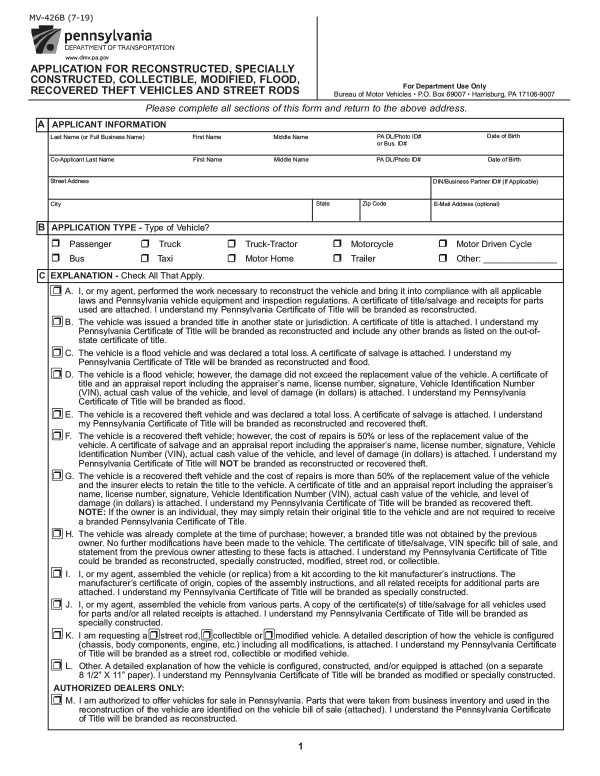

VIN verification is required for out of state vehicles. Pennsylvania Certificate of Title. Pennsylvania collects a 6 state sales tax rate on the purchase of all vehicles with the exception of Allegheny County and the City of Philadelphia.

Lowest sales tax 6 Highest sales tax 8 Pennsylvania Sales Tax. The use tax rate is the same as the sales tax rate. The fee schedule is as follows.

Nine-digit Federal Employer Identification Number or Social Security number or your 10-digit Revenue ID. 6 tax rate and more In Pennsylvania a vehicle is subject to sales tax since its considered personal property. Calculate By Tax Rateor calculate by zip code.

Average Sales Tax With Local. Pennsylvania State Sales Tax. BUREAU OF DESK REVIEW AND ANALYSIS.

Some dealerships may also charge a 113 dollar document preparation charge. If the vehicle will be registered in Allegheny County PAs 2 nd most populous county theres an added 1 local sales tax for a total of 7 sales tax on a vehicle purchase. Pennsylvania sales tax is 6 of the purchase price or the current market value of the vehicle 7 for residents of Allegheny County and 8 for City of Philadelphia residents.

If the vehicle is being given as a gift the Form MV-13ST PDF Affidavit of Gift must be attached to the title application. In Philadelphia theres an extra 2 sales. Groceries clothing prescription drugs and non-prescription drugs are exempt from the Pennsylvania sales tax.

The car dealer will follow the sales tax collection laws of their own state. 21200 for a 20000 purchase. See Malt Beverage Tax Rate Table.

Source The provisions of this 3148 adopted September 29 1972 effective September 30 1972 2 PaB. Eight-digit Sales Tax Account ID Number. Pennsylvania has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 2.

Calculate By ZIP Codeor manually enter sales tax. This form must be completed by all transferees and transferors and attached to Form MV-1 or MV-4ST for any transfer for which a gift exemption Exemption 13 for purposes of Pennsylvania Sales and Use. Motor vehicle sales tax is paid directly to the Department of Transportation which acts as a collection agent for the.

Effective October 30 2017 a prorated partial day fee for carsharing services was provided as a clarification to the current vehicle rental fee. The car sales tax in Pennsylvania is 6 of the purchase price or the current market value of the vehicle according to the PennDOT facts sheet. Exact tax amount may vary for different items.

While the Pennsylvania sales tax of 6 applies to most transactions there are certain items that may be exempt from taxation. Find sales tax rates in Pennsylvania by address or ZIP code with the free Pennsylvania sales tax calculator from SalesTaxHandbook. That way you dont have to deal with the fuss of trying to follow each states.

To verify your Entity Identification Number contact the e-Business Center at 717-783-6277. There are a total of 68 local tax jurisdictions across the state. DMV Vehicle Services Vehicle Information Selling a Vehicle in PA.

The sales tax rate for Allegheny County is 7 and the sales tax rate in the City of Philadelphia is 8. The motor vehicle sales tax rate is 6 percent the same as on other items subject to sales tax plus an additional 1 percent local sales tax for vehicles registered in Allegheny County and a 2 percent local sales tax for vehicles registered in Philadelphia. Begin Main Content Area.

States With Highest And Lowest Sales Tax Rates

Car Sales Tax In New York Getjerry Com

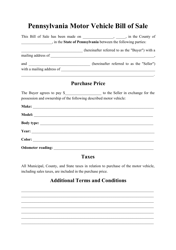

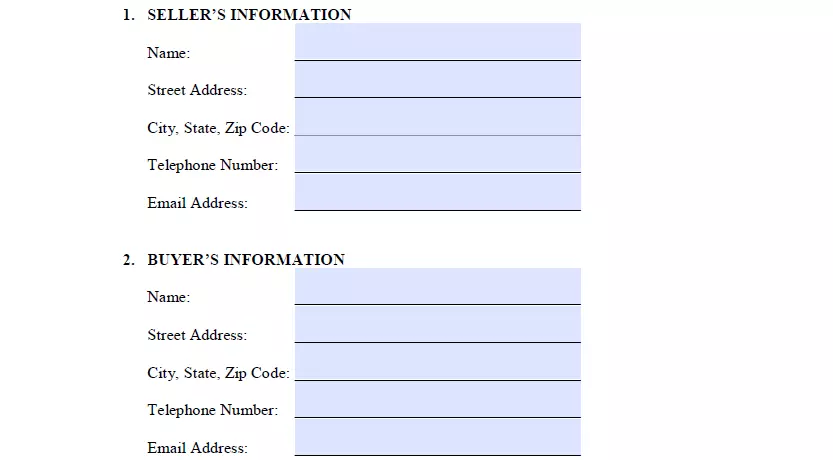

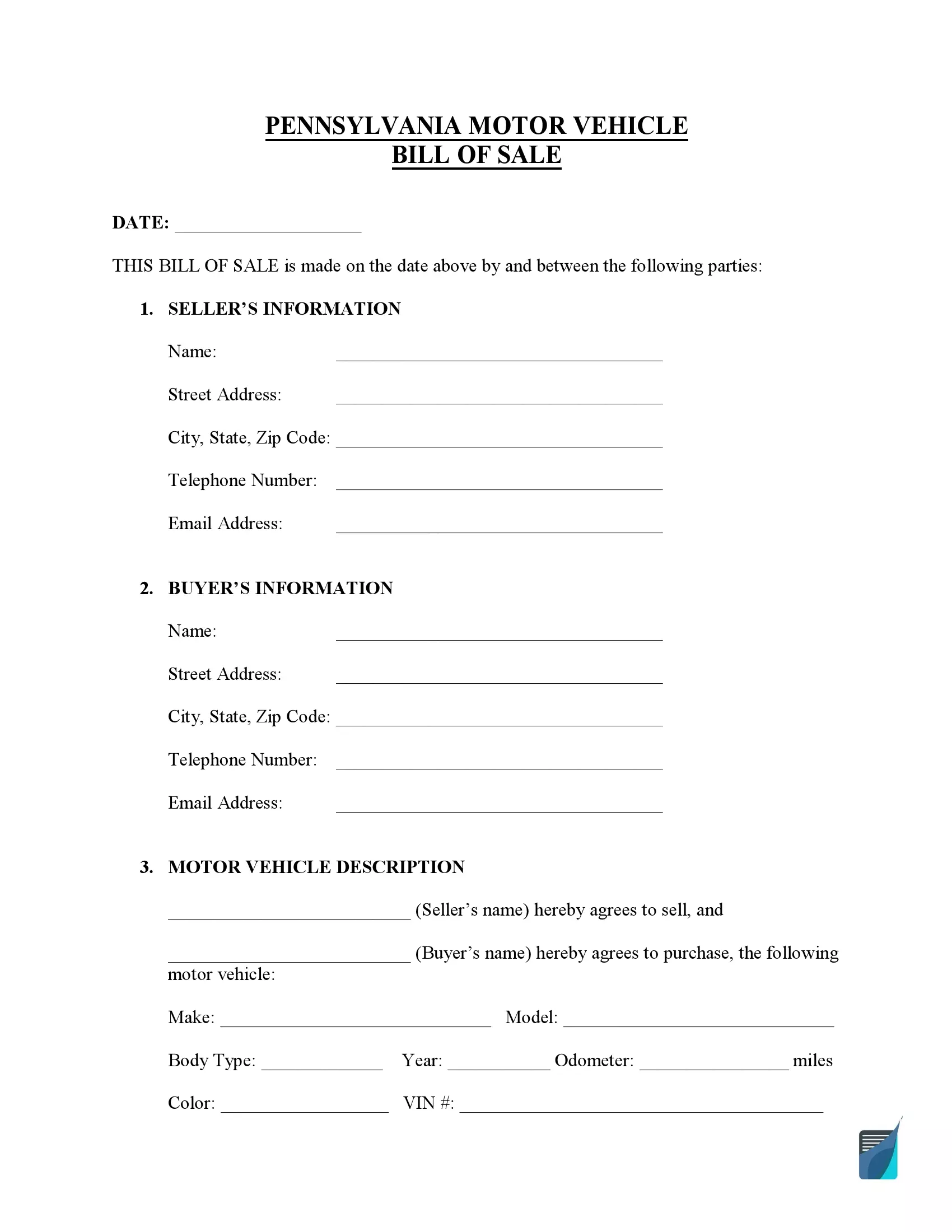

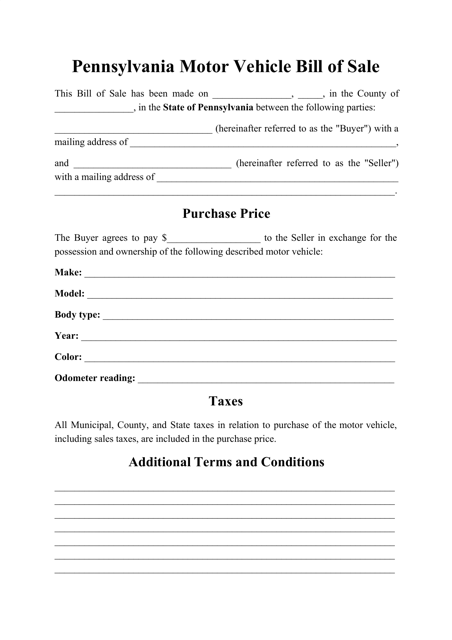

Pennsylvania Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

How To Register A Car In Pennsylvania Metromile

Free Pennsylvania Vehicle Bill Of Sale Form Pdf Formspal

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

What Is Pennsylvania Pa Sales Tax On Cars

Virginia Sales Tax On Cars Everything You Need To Know

What S The Car Sales Tax In Each State Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Car Bill Of Sale Pdf Printable Template As Is Bill Of Sale

Free Pennsylvania Bill Of Sale Forms Pdf

Pennsylvania Sales Tax Small Business Guide Truic

Free Pennsylvania Bill Of Sale Form Pdf Template Legaltemplates

Free Pennsylvania Vehicle Bill Of Sale Form Pdf Formspal

Pennsylvania Motor Vehicle Bill Of Sale Form Download Printable Pdf Templateroller

Car Sales Tax In Delaware Getjerry Com

Bills Of Sale In Pennsylvania All About Pa Forms And Facts You Need

What S The Car Sales Tax In Each State Find The Best Car Price